PDVSA’S Missing Billions

From World Energy Monthly Review

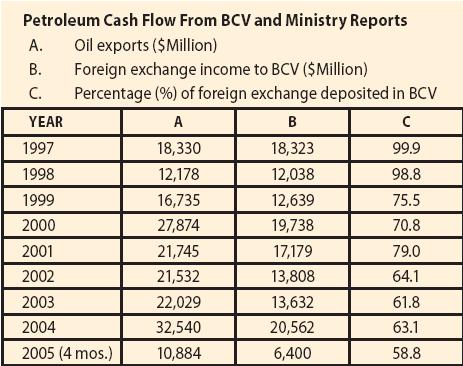

14.07.05 | Vol. 1 No. 4 July 2005 | One of the oldest slogans in politics is "follow the money" and in Hugo Chavez’s Venezuela that process is getting more difficult by the day. World Energy Monthly Review has analyzed records from Petróleos de Venezuela S.A. (PDVSA) and the Venezuelan Central Bank (BCV), and we found a substantial discrepancy in the reporting of funds officially going into the Venezuelan treasury. By our estimate, at least $3.5 billion – money that should have been deposited into the BCV – has disappeared. And Venezuelan officials will not (or perhaps cannot) explain where the cash has gone.

Some of the missing revenue may be due to shipments of Venezuelan crude to Cuba, a deal that involves barter, not cash. Chavez gives Fidel Castro oil; Castro gives Chavez medical doctors, nurses and skilled labor. But the value of that 50,000-barrel-per-day deal accounts for only a portion of the missing sum. Furthermore, World Energy Monthly Review’s calculations suggest that PDVSA’s internal oil production is at its lowest level in three decades.

There are other questions:

• According to BCV’s director, Dr. Domingo Maza Zavala, his bank received $1.6 billion per month between January and April of 2005. It should be getting about $2.7 billion. That means that every month in Caracas, $900 million goes missing.

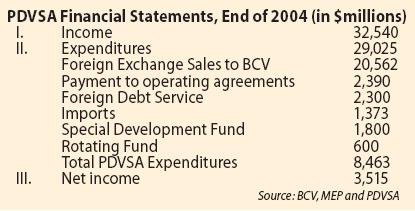

• PDVSA’s payments to foreign suppliers totaled $1.4 billion in the first four months of 2005. That’s a dramatic increase from the $1.3 billion paid to those suppliers in 2004. Furthermore, the $1.4 billion cost of those imports was not registered as part of PDVSA’s rotating fund, which is supposed to be used to finance the company’s external operations.

• On May 20, Petroleum Minister (and PDVSA head) Rafael Ramirez apparently confirmed that Venezuela’s production in the first four months of 2005 averaged 2.623 million barrels per day from all sources. Thus, PDVSA has abandoned its long-held-but-discredited claim that it was producing 3.5 million barrels. (It has also claimed that production was 3.2 million barrels per day.)

• PDVSA’s total 2004 export revenue was about $32.5 billion. That figure translates into daily exports of about 1.7 million barrels at about $50 per barrel. If one believed PDVSA’s claim that it is producing 3.5 million barrels per day, then the country’s export revenue for 2004 should total more than $50 billion – and that means the missing revenue is far higher than the $3.5 billion we cited above. Further, if one believes that Venezuela is producing 3.2 million barrels per day, then the total revenue would be $47 billion. Under any scenario, there are mountains of missing cash.

• If the 2.6 million barrels per day figure is correct – and we believe it is – then PDVSA’s own internal production has fallen to its lowest level in nearly 30 years. Here’s the math: Subtract 500,000 barrels per day that come from operating agreements, and another 617,000 barrels that come from strategic associations in the Orinoco Belt, and you have the company’s legacy production, a total of about 1.5 million barrels per day, the lowest level since PDVSA’s creation in 1976.

A spokesman for PDVSA told us that neither the company nor the Venezuelan embassy in Washington would respond to our questions about these issues. Their lack of a response may indicate the predicament that Chavez faces: On one hand, PDVSA wants to show that its production isn’t falling. At the same time, the Chavez government doesn’t want to brag too much about oilfield prowess because high production means lots of cash inflows to the government – and that cash has vanished.

What Are They Hiding?

The lack of transparency in PDVSA’s dealings with the BCV, its production levels and its export revenue are only arousing the suspicions about the Chavez Administration. In 2003, PDVSA discontinued the publication of its annual report, "Petroleum and Other Statistical Data." The company has also not published its financial statements, even though it is required to do so by SEC rules. (It is required to do so because PDVSA owns significant assets in the United States, including the Citgo gasoline retail chain, and has production-sharing agreements with several U.S. companies.)

The first real glimpse into PDVSA’s condition came on May 20, 2005, when the company finally released its oil production and export figures. But instead of quieting the Chavez opposition, these statistics only fanned the flames. César Rincones, head of the National Assembly Comptroller’s Commission, said he is determined to find out where the money has gone.

Rincones should follow the money trail wherever it leads. It is becoming clear that the problem today in Venezuela is not Chavez’s politics. He’s the president and he can lead the country wherever he likes. The problem is one of accounting, and therefore, accountability. Unless or until a full accounting is made for the shortfalls at the BCV, scrutiny of the Chavez administration will remain intense.

send this article to a friend >>